Earlier this week, I commented to Jane that stocks have never lost money in any period longer than 13 years.(1) Her response was, “But today they’re down.” That was news to me. I hadn’t even checked. I don’t pay close attention to daily price changes. Anyway, we’re not selling today. It doesn't matter.

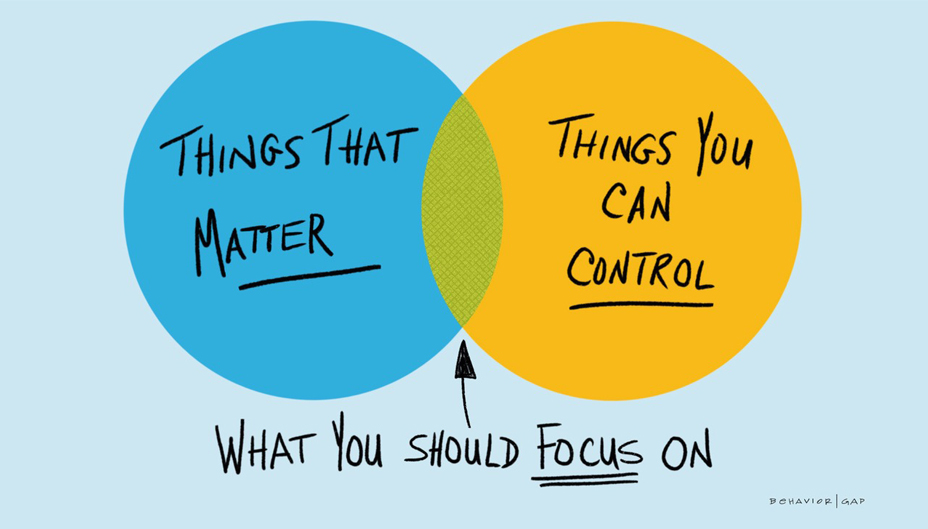

This triggered more thinking about what matters and what we can control. (Hat tip: Carl Richards, Behavior Gap)

What matters is deciding on what goals to move toward, or of sustaining a particular lifestyle, like say, retirement. Some of that involves financial planning. Surprisingly, much of it doesn't. But all of it is in our control.

What may seem to matter, but over which we have no control is what we hear and see on the daily news noise. Inflation. Ukraine. Interest rates. Pandemic. Oil. The Fed balance sheet. So, do yourself a favor. Limit news consumption.

The "sweet spot" is to find where what matters overlaps with what you can control. Here's the path to the financial sweet spot.

👉 You have well-honed habits of spending awareness. You're clear about what matters and what's worth paying for. I call it the "price/value proposition."

👉 You give saving a high priority. We often call it "paying yourself first." If you've already retired reached optionality, you can enjoy not having to save anymore.

👉 You know you are not smarter than the financial markets. So you invest using a low-cost, globally diverse strategy.

👉 You wisely manage your money emotions. That means managing fear and greed. I like to say that "the hardest thing to do is the rightest thing to do."

What's the payoff?

Look. Anyone who has done these things over the past 10, 20, 30 years has far outrun the inflation that's in the news. It's called "living off the fat of the land."

In the meantime, when you hear, see, or read something alarming or troubling in finance or economics, just ask yourself, "Does it matter? Can I control it?"

As financial planners, these are the conversations we look forward to having. Here's how to contact us.

James Cosgrove, CFP, Plano, TX jim.cosgrove@verizon.net 972-489-0262

Jim Cosgrove, Partner, San Jose, CA jimcos42@gmail.com 408-674-6315 Twitter@JimCos542

(1) https://mobile.twitter.com/wintonARK/status/1509197050918977539